Table of Contents

Who is Michael Burry?

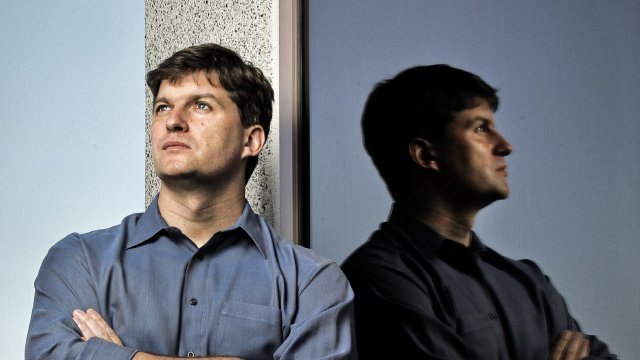

Dr. Michael Burry, the former CEO of Scion Capital Group, LLC is renowned as the first person to foresee the financial collapse in America and the first person to devise trades to benefit from it. Apparently, he predicted that the housing bubble would collapse as early as 2007, and he followed through on this prediction by using credit default swaps to wager against subprime mortgages. Additionally, Michael also predicted the downfall of organizations including AIG, Fannie Mae, Freddie Mac, Countrywide Financial, and Washington Mutual.

Moreover, the American physician investor as well as hedge asset manager Michael Burry founded and successfully managed Scion Capital LLC for eight years. Burry then closed this fund in 2008 in-order to focus on his personal investments. Remarkably, he was one of the select few investors who bravely ventured into the mortgage industry during the recession. Besides, he was represented in Michael Lewis’ 2010 book “The Big Short”, which he wrote as a columnist for Bloomberg. Michael’s narrative was in-fact covered in an excerpt from the book that appeared in the April 2010 issue of Vanity Fair.

Profile of Michael Burry

| Full Name | Dr. Michael James Burry |

| Popular As | Michael Burry |

| Birthdate | 19th June, 1971 |

| Place of Birth | San Jose, California, USA |

| Gender | Male |

| Profession | Investor, Hedge fund manager, Physician |

| Nationality | American |

| Race / Ethnicity | Undisclosed |

| Religion | Undisclosed |

| Education Qualification | Graduate |

| University | Vanderbilt University School of Medicine, Stanford University Hospital & University of California |

| Sexual Orientation | Straight |

| Age | 51 Years Old |

| Sun-sign | Gemini |

| Eye color | Brown |

| Hair Color | Dark Brown |

| Height | 5’6” (170 cm) |

| Marital status | Married |

| Parents | Undisclosed |

| Siblings | Undisclosed |

| Girlfriend/Boyfriend/Spouse | Undisclosed |

| Children | Undisclosed |

| Net Worth | $300 Million USD |

Michael Burry, a physician turned investor, amassed his wealth by outperforming the market when everyone else was going bankrupt. In-fact, Burry is a courageous investor who is renowned for taking the swift route when everyone else struggling.

Early-life, Education & Family Background

Michael James Burry was born on 19th June, 1971, in San Jose, California. A cancer patient who lost one eye at the age of two, he spent his infancy as a shy youngster with few social skills. Apart from this, the information entailing his family, parents, siblings as well as his family origin has not been disclosed publically.

Unfortunately, Michael lost his left eye to cancer when he was a youngster and was later diagnosed with Asperger’s Syndrome in adulthood. Many believe his diagnosis results in his unique perspective on Wall Street.

As far as concerned to his academics, Michael he received his medical education at the University of Los Angeles (UCLA) and went on to obtain his PhD at Vanderbilt University School of Medicine. Eventually, he earned an economics degree in 1993. Following completing his medical degree at Vanderbilt, he inevitably decided to leave medicine after his third year of neurology residency at Stanford University Hospital in order to pursue investing full-time.

In the meanwhile, he worked part-time as a financial investor while pursuing his residencies in neurology and pathology at the Stanford Hospital. Eventually, Michael completed his neurologist residency at Stanford. Moreover, he also pursued pre-med and economics degrees at the University of California. Thereafter, Michael established Scion Capital in 2000 with the backing of a little inheritance. Consequently, due to his outstanding achievement in “value investing,” he had already established a spectacular profile as an investor.

Michael Burry’s beginning in the Investment Market

Contrary to other well-known investor profiles, Burry considered finance to be a hobby. By the beginning of the 2000s, Burry was able to quit his job managing a residency program and focus solely on managing hedge funds. He oversaw the assets of well-known customers like Vanguard, Joel Greenblatt, and White Mountains Insurance Group after launching Scion Capital. Further, throughout the decade of the 2000s, Michael Burry’s contrarian investing approach was profitable since he took full advantage of the turbulence in the internet industry and the subprime loan sector.

More specifically, Dr. Burry was able to spot equities that were overpriced in reference to their inherent worth using fundamental methodological approaches he learnt from David Dodd and Benjamin Graham. Burry was successful in shorting many stocks that he believed were being overvalued by speculative investors at the height of the dot-com crisis.

Meanwhile, Burry experienced a streak of victories as the manager of the now-defunct hedge fund Scion Capital starting in the early 2000s. During that time, he generated large earnings during the dot-com bubble and the collapse of the subprime mortgage market attributable to his aptitude for speculative trading. Accordingly, Michael became well-known for speculative trading according to his track record of offering substantial and outstanding returns during economic slowdowns.

Likewise, major investors like Joel Greenblatt and huge organizations like Vanguard and White Mountains Insurance Group were interested in his Forbes “Best of the Web” finance website and blog. Following closing Scion Capital in 2008, Michael now funds businesses and uses his personal wealth to finance investments from his Cupertino, California, office. Pricetector, Xola.com, and Zeta Instruments are a few of his recent venture investments. Burry was so well-known that Christian Bale’s portrayal of him in the 2015 movie “The Big Short” was based on him.

His Journey to Success

During the early phase of his investment career, Michael launched his own blog as a novice investor and published stock market trends as well as his trade recommendations. As a matter of fact, he approached investing as a complete job when he first started doing it. In contrary to his amateur career, Burry quickly caught considerable interest of other prominent fund managers in the sector as well as investment banks like Morgan Stanley.

Resultantly, later in 2000, he decided to leave the medical field and launch Scion Asset Management, an investing firm. In addition, Michael had to deal with Asperger Syndrome and found challenging to converse with the clients he was managing assets for at the time. Instead, he opted to write letters to his investors to update them on the status of their investments.

Initially, Burry leveraged his property and borrowed money to launch his investing firm. Based on inside sources, the fantasy book ‘The Scions of Shannara’ by Terry Brooks served as the inspiration for the name of his firm. Resultantly, his business produced a sizable profit for the company’s stockholders in 2001 and the business performed admirably in the following years as well.

Remarkably, the subprime mortgage crisis was foreseen by hedge fund manager Michael J. Burry, who is renowned for having correctly predicted the real estate crisis. Moreover, he was amongst the very first investors to issue a housing market warning.

Michael Burry’s Professional Career

Burry began studying the real estate sector in 2005, and as a result of his research, he entered the mortgage industry. He examined the costs of mortgage financing in 2003 and 2004 and correctly predicted that the bubble would pop in 2007. Following this, Burry participated in financial forums and posted his thoughts and forecasts on his own website by the middle of the 1990s, by which time he had already established himself as a prominent fund manager.

Subsequently, He took the decision to permanently leave medicine in 2000 and transitioned from being a novice investor to founding his own investment company, Scion Capital. Reportedly, the Scion Capital was generating returns to its investors of 55% in 2001, while the S&P 500 was down 11.8 percent, demonstrating Burry’s discerning sense. The following years, Burry’s fund increased by 16 percent while other firms suffered hugely.

Due to Burry’s almost compulsive conduct brought on by his self-diagnosed Asperger’s syndrome, he was already handling $600 million in 2004. Meanwhile, Burry rejected this money in spite of the fact that numerous investors sought him out to handle their assets. Moreover, Burry studied hundreds of proposals for mortgage-backed securities as a result of the same compulsive tendency that drove him to seek for the finest prospects. Incredibly, it was then that he came to the realization that the real estate market was offering far too many high-risk loans.

Burry acknowledged the existence of the investment inflation and projected its deflation in 2007. Thereafter, he persuaded banks to issue CDIs and sell them to him. As consequence, with the help of this radical action, Michael Burry solidified his reputation as a financial genius, earning him and his investors a profit of around $1 billion during the big subprime credit crisis of 2008–2009.

Michael’s Investment & Strategy

Particularly, Michael Burry has repeatedly clarified that he considers himself a value investor and that he based all of his investing decisions entirely on the “margin of safety” idea put out by David L. Dodd and Benjamin Graham. Moreover, finding assets whose intrinsic worth is higher than their price is the goal of this margin, with the hope that, in the long run, the asset will reach or even surpass the price that reflects that intrinsic value.

Additionally, Burry is currently focused only on managing his own funds since his retirement in 2008. Nonetheless, in 2013, he launched a new investing company called Scion Management, where he places significant bets on commodities like gold, start-up companies, and real estate. Reportedly, he has projected that water is the most precious asset and that it will progressively become scarce since 2010, thus he has not chosen these investments at random. As a result, he maintains them centered on his own prediction.

Furthermore, Michael also wants to keep reserves of gold, modest technologies, and assets with a margin of safety while enjoying exclusive access to water. Besides, he has also invested in technological ventures including Facebook and Alphabet Inc.

Honors & Achievements

Michael Burry is a remarkable investment tycoon who, in spite of all the challenges, managed to establish himself and scale incredible heights in his profession. At present, he is regarded as one of the top American investors and a very successful one. His company ‘Hedge Fund Scion Capital’ which has been shut down formerly achieved tremendous success while it was in operation.

Later on, Michael folded down the company to concentrate more on his investments. In addition, he is also a certified physician and has kept his license till date, but has never actually works as one. Furthermore, he was represented in the documentary movie The Big Short as well where Cristian Bale who portrayed his character.

Burry’s Personal-life & Relationships

Michael Burry appears to be maintaining a very private lifestyle. There is no information available concerning Michael Burry’s personal affairs. With that being said, it has been mentioned that he is in-fact a married man, however, the details are kept discrete.

Social Media Handles of Michael Burry

Regrettably, Michael Burry is not accessible on social media sites like Twitter, Facebook, or Instagram. Secondly, the accounts under his identity have not yet undergone official verification.

Net Worth of Michael Burry

Based on several credible sources including Yahoo Finance, accomplished investor Michael Burry has a personal net worth of roughly $300 million given his impressive credentials. It is further claimed that Burry’s personal net worth is close to this amount because a major portion of his investing history is disclosed in Securities and Exchange Commission (SEC) filings. Moreover, his personal worth is highly influenced on the $2 billion assets that are managed by Scion Asset Management under his extremely exclusive hedge fund.